You’re halfway through National Preparedness Month! Now it is time to strengthen your financial preparedness for disasters and emergencies.

When it comes to emergencies, Pennsylvanians face more than flooding, tornadoes, and snowstorms. We also deal with broken hot water heaters, damaged roofs, and sudden medical expenses.

Recent data shows that a significant number of homes affected by flooding were not in a flood zone, and many found the recovery process to be challenging and expensive, if not completely insurmountable.

Being financially prepared can seem difficult. These small but critical steps this week could help with covering your assets when the unexpected occurs. Let’s get started!

#15: Get started by watching this.

Watch this. Being financially prepared can seem like a daunting task.

Less daunting is watching this three-minute video from the Federal Emergency Management Agency (FEMA). It helps explain why financial preparedness is so important.

Disasters can happen anytime and anywhere. You can protect yourself and your finances by planning ahead. A weekend of prep now, can save you frustration and money later.

#16: …and then keep going.

There is a lot to digest. Which is why PEMA and the Pennsylvania Department of Banking and Securities created this digest.

You may only have hours or minutes to react after a natural disaster or other emergency. Recovering will be tough, but taking several easy steps will help you put your finances and documentation in order.

#17: Think hazard, not just flood.

Contact your insurance company. Ask what is covered...and what is not.

Most homeowner’s policies don’t cover damage from flooding, sinkholes, earthquakes, or sewer backups. Separate policies are required for flood coverage, and riders to your policy are needed for the other added coverage.

Don't own your home? Your landlord’s policy covers damage to the building, but not to your possessions. Likewise, a roommate’s renters insurance likely does not cover your stuff.

Learn about renters insurance and more from the Pennsylvania Insurance Department.

#18: But definitely think flood, too.

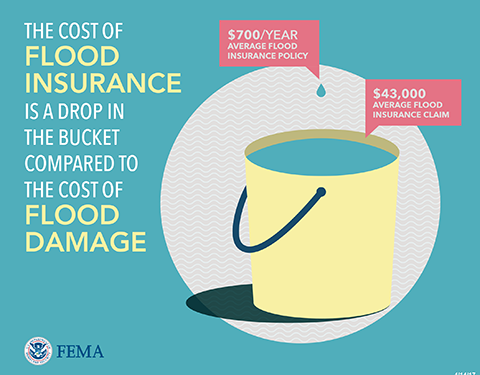

Why is flooding such a hot topic right now?

Because more than 20 percent of all flood claims are for properties mapped outside of high-risk flood areas.

It doesn’t take much water to cause a lot of damage. Just a few inches of water can cause tens of thousands of dollars in damage. And standard homeowner's or renter's policy does not cover damages resulting from a flood.

Learn the myths and facts about flood insurance.

#19: Document what you have.

Take photos or videos of rooms in your home, showing what you own.

This provides documentation if you need to file a claim.

Keep these records, along with as many receipts as you have for large items, in a safe place, such as a bank safe deposit box or with your other emergency documents.

Print this information from the Pennsylvania Insurance Department. It lists what to expect and what you need to do “after the storm.”

#20: Collect your documents.

Make your own Emergency Financial First Aid Kit.

Place important documents such as deeds, birth certificates, passports, wills, titles, and financial documents in a safe deposit box at a bank or credit union.

Keep copies of these documents in a zip lock bag and fire-safe box that you can easily access and take it with you in emergencies.

#21: Why money talks. Even the small bills.

Stash some cash. Start with a few dollars and add to it every two weeks.

When power goes out in your home, it may also be out in your neighborhood. If that is the case, you may not be able to use banking cash machines or be able to pay for necessary items at the store with a credit card.

When budgets are tight, it can be difficult to have cash stored for emergencies. How much you need depends on your family size and other circumstances, but consider essentials such as gasoline, bus or train fare, and several nights of lodging and food.

Check out the Ready PA Action Sheet about “stashing your cash.”